Construction Industry Scheme deductions: advice for contractors

HMRC is currently shining a spotlight on the construction sector as records are showing that some contractors are making incorrect Construction Industry Scheme (CIS) deductions. In this blog the Clayton & Brewill team discuss what you must do as a CIS contractor, including the most recent deduction rates and how to make a CIS reduction. […]

Essential employer update 2025

Clayton & Brewill guide you through the latest issues in payroll, tax and employment law. From April 2025 several changes are coming into force that employers should be aware of, including updated minimum wage, National Insurance and employee hours. Download our briefing note below to learn more. Download the briefing note here. Working with you […]

February 2025 newsletter: the latest updates from Clayton & Brewill

Clayton & Brewill’s February 2025 newsletter is now available to view online. After a busy 2024 we are now well and truly settled into 2025 and are starting to see the first signs of spring with lighter evenings and warmer weather. In our latest newsletter, we look at a number of key talking points in […]

How to get tax on employment benefits right

With particularly complex rules, getting the tax on employment benefits right for directors and employees can seem like a minefield. Recent research by The Global Payroll Association showed that errors in this area are routine. Its survey revealed that 25% of employees responding had been wrongly paid: and that 11% of these errors related to […]

December 2024 newsletter: the latest updates from Clayton & Brewill

Clayton & Brewill’s December 2024 newsletter is now available to view online. We are well and truly into the winter season now with many areas even seeing snowfall in the last few weeks. We hope you are enjoying the last few weeks of the year and are looking forward to 2025. In our latest newsletter, […]

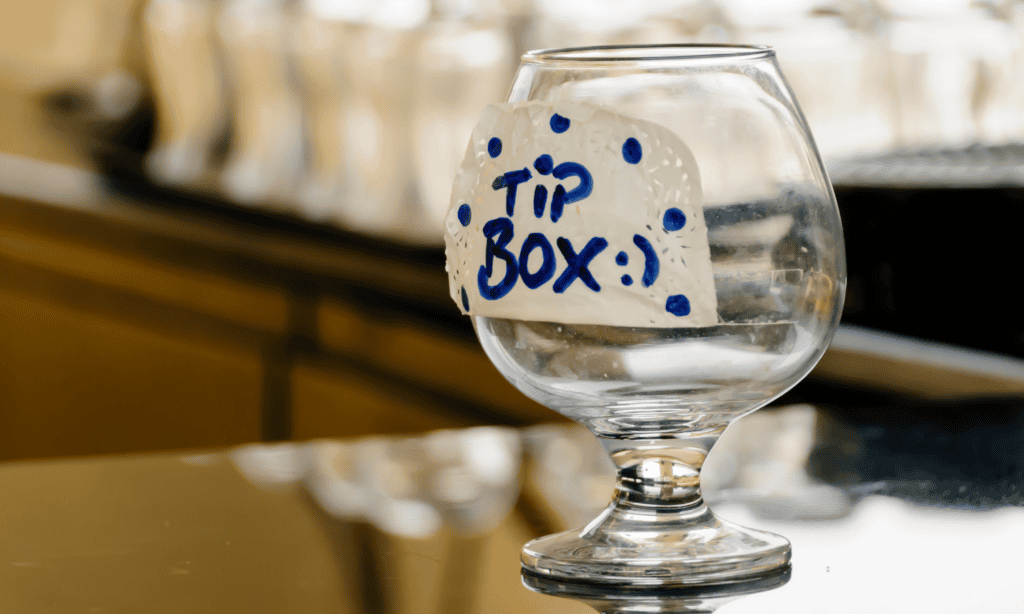

The Tipping Act: what employers need to know before the upcoming changes

The Employment (Allocation of Tips) Act 2023, often referred to as the Tipping Act, states that all tips should be passed on to workers without deductions. The Act was originally set to come into force on 1 July 2024 but has now been pushed back to 1 October 2024. The Clayton & Brewill team explains […]

Travel expenses for flexible and hybrid workers

Travel costs make up a large part of necessary expenditure for many businesses and with the continued popularity of hybrid and flexible working it is important that allowable travel expenses reflect this. HMRC has recently updated its guidance on ordinary commuting and private travel, adding a new section to clarify the rules on claiming tax […]

Changes to holiday pay and entitlement: irregular hours and part-year workers

Almost everyone classed as a ‘worker’ — a definition going wider than just employees — is legally entitled to 5.6 weeks’ paid holiday each year. This includes workers with irregular hours and part-year workers. From April 2024, new rules will change how holiday pay is calculated for workers, including an accrual method based on hours […]

July 2024 newsletter: the latest updates from Clayton & Brewill

Clayton & Brewill’s July 2024 newsletter is now available to view online. Summer holiday season is well and truly upon us, and it’s nice to see a return of the sunshine this week. We hope those of you going away enjoy a relaxing break. In our latest newsletter, we look at a number of key […]

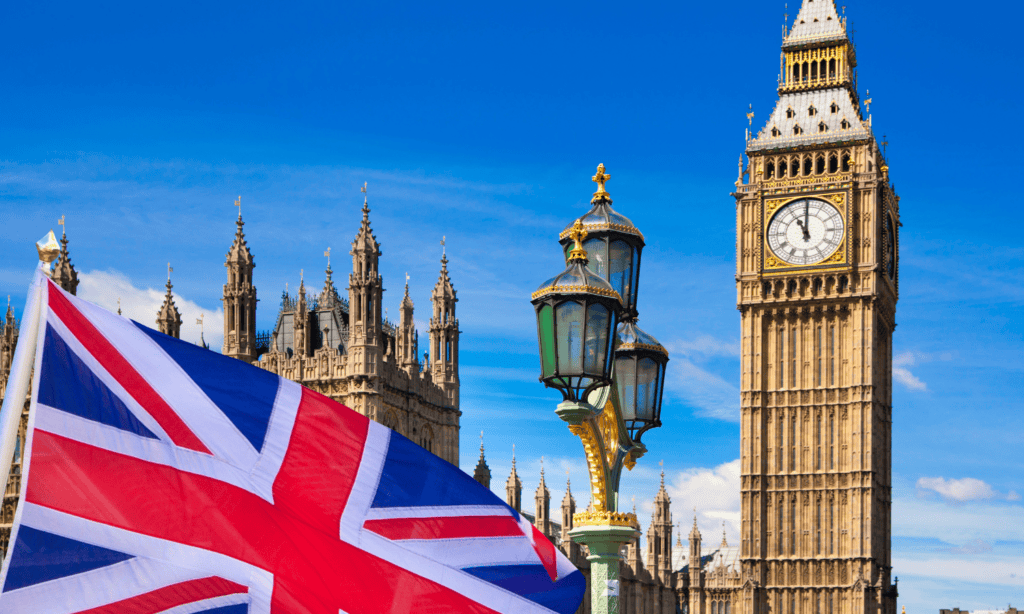

What do the results of the 2024 General Election mean for businesses?

In the early hours of 5 July 2024, it was announced that the Labour Party had won the majority in the 2024 General Election. Entering Downing Street as Labour’s first prime minister in 14 years, Sir Kier Starmer has declared that “change begins now.“ But what does this win mean for businesses? In this article, […]