PAYE: avoiding unwanted attention from HMRC

Recent tax figures show a gap of over £3 billion for PAYE, and this is being regarded as due to employer errors. In this blog, the Clayton & Brewill team discuss these tax gap figures and how employers can ensure they don’t end up on the wrong side of HMRC’s statistics. What is the PAYE […]

New tax rules for double cab pick-ups

As announced in the Autumn Budget, from 6 April 2025 double cab pick-up trucks with a payload of at least one metric tonne will be classified as cars for benefit in kind (BIK) or capital allowance purposes. Clayton & Brewill explain what these new rules could mean for you and your business and how long […]

Jointly owned property: getting the rules right

Many individuals do not realise that HMRC automatically treats income from jointly owned property that has been let out as being split equally between spouses, unless an election has been made to change this. In this blog, the Clayton & Brewill team discusses the tax rules behind jointly owned property and why seeking professional advice […]

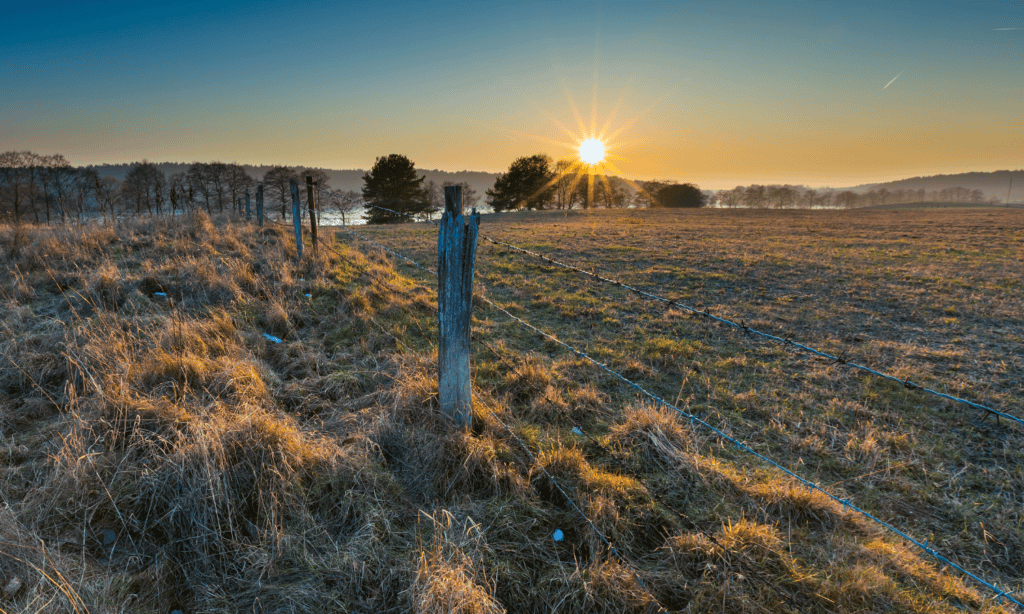

Major change in tax rules for furnished holiday lettings

Preferential tax rules for furnished holiday lettings (FHLs) will end in April 2025, removing any tax incentive for individuals to offer short-term holiday lets. With April fast-approaching, the expert team at Clayton & Brewill discuss the upcoming changes and how these may impact you. What is changing? Admin – rather than being calculated and reported […]

Essential employer update 2025

Clayton & Brewill guide you through the latest issues in payroll, tax and employment law. From April 2025 several changes are coming into force that employers should be aware of, including updated minimum wage, National Insurance and employee hours. Download our briefing note below to learn more. Download the briefing note here. Working with you […]

February 2025 newsletter: the latest updates from Clayton & Brewill

Clayton & Brewill’s February 2025 newsletter is now available to view online. After a busy 2024 we are now well and truly settled into 2025 and are starting to see the first signs of spring with lighter evenings and warmer weather. In our latest newsletter, we look at a number of key talking points in […]

What is Time to Pay and can my business use it?

If a business or individual is struggling to make a tax payment because of genuine financial hardship or personal difficulties, then they may be eligible for a Time to Pay (TTP) arrangement. As we approach the Self Assessment tax return deadline, the Clayton & Brewill team discusses TTP and how it can be useful for […]

Don’t miss the Self Assessment tax return deadline

Following all the Christmas festivities, it can be easy to forget that the 31 January deadline for submitting your Self Assessment tax return is just around the corner. Clayton & Brewill explains why you must ensure your submission is correct and on time so you can avoid any unnecessary penalties. Who must send a tax […]

How to get tax on employment benefits right

With particularly complex rules, getting the tax on employment benefits right for directors and employees can seem like a minefield. Recent research by The Global Payroll Association showed that errors in this area are routine. Its survey revealed that 25% of employees responding had been wrongly paid: and that 11% of these errors related to […]

Keeping up to date with VAT

The world of VAT is always changing. ‘Every question answered seems to give rise to three more’, according to one expert commentator. To help keep your business up to date with VAT developments, Clayton & Brewill takes a look at some of the basic questions here. Also, in the light of a recent VAT case […]